Home Ownership Incentive Program

Navigation Sidebar

To assist with the dream of homeownership, the University has teamed up with the City of Rochester and several banks/credit unions to offer regular full-time and part-time faculty and staff, residents and fellows* $9,000 toward the purchase of a primary residence.

The University Home Ownership Incentive Program through Total Rewards provides new homeowners in the following charming and convenient City of Rochester neighborhoods † with:

- $3,000 from the University

- $3,000 from the City

- $3,000 from a participating bank/credit union ‡

There are no maximum income requirements, but the plan requires five-year occupancy and employment commitments from the buyer.

The approval process for Home Ownership benefits may take up to four months and may require completion of pre-purchase and post-purchase education classes at approved agencies.

Watch our Home Ownership Incentive Program video overview.

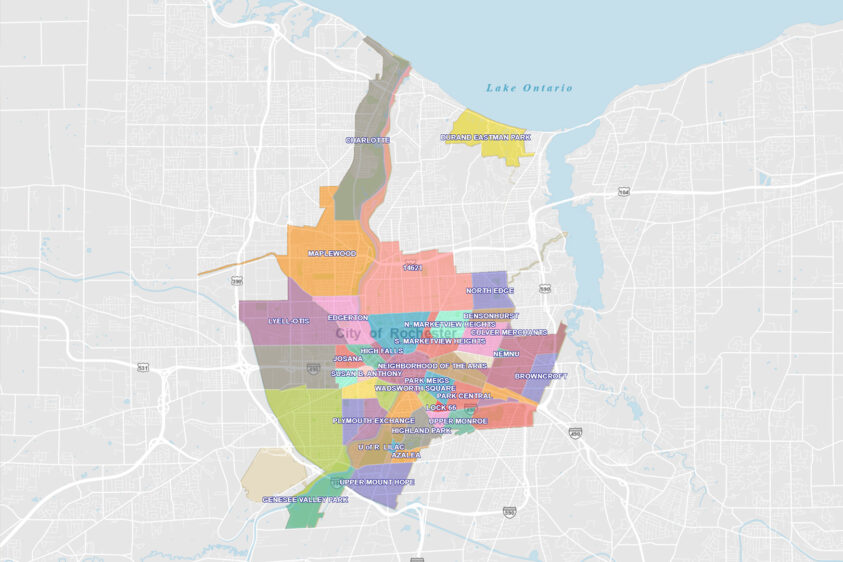

Qualifying neighborhoods and streets

The above map should be used as a general reference only. If a property is bordering another neighborhood, please contact the City at (585) 428-6888 to confirm that a property is eligible.

If you are buying a home outside of these neighborhoods, check out the Mortgage Housing Incentive Program below in the resources section.

Home ownership benefits: additional resources

The University of Rochester works with a variety of program lenders.

Several financial institutions in the Greater Rochester area are available to help the University of Rochester’s full-time and part-time faculty and staff members through the mortgage process.

By answering your questions, informing you of their housing incentives, and explaining their specific mortgage options, you will be able to make an informed decision about what the best mortgage options are for you.

This program also offers special incentives for homebuyers in the City of Rochester.

Find Your Dream Home

Owning a home isn’t just about four walls and a roof. Do you want a backyard, or for someone to take care of all the maintenance for you? Are you looking for that Victorian style, but modern home, or is it most important to live on a street with lots of shops for your convenience? Well, check out the Celebrate City Living website to find your dream home!

Assistance & Advice

Stressed out or confused about the home buying process? Need a little advice or just want to take a class to make sure you’re doing everything right? Sign up for pre-purchase and post-purchase education classes at approved agencies*, to be the best you can be at home buying.

*To be eligible for the City of Rochester’s grant, first-time home buyers are required to complete pre-purchase and post-purchase education classes at approved agencies. Contact the City for confirmation of approved agencies.