Compensation

Attract top talent, motivate employees, and reward performance.

Valuing excellence

The University of Rochester is a community where all can pursue and achieve their highest objectives for themselves, their community, and the world. Faculty and staff should have the tools to achieve success and be rewarded for hard work. Our aim is to attract, motivate, reward, retain, and develop quality employees.

Topics on this page

Compensation Philosophy

A compensation philosophy is a formal statement defining the guiding principles of an organization’s position on employee compensation. It explains the rationale behind employee pay, creates a framework for consistent pay, and forms the basis of our pay administration guidelines.

The University of Rochester recognizes that our employees are at the heart of our institution, and we strive to create a supportive, equitable, and inclusive work environment where all employees can thrive.

In order to succeed in our academic, research, and clinical missions, we must develop, attract, retain, and engage a highly qualified and diverse workforce. The University of Rochester’s compensation philosophy aligns and supports these goals in a way that is objective, comprehensive, and designed to evolve with our organization.

Our compensation philosophy will be administered and maintained by the Compensation Governance Committee, comprised of senior leadership from across the University.

Transparency: Compensation policies, guidelines, and procedures will be as transparent as possible

Structure: A clear and articulated approach enables more consistency across the University

Adaptability: Strategies support today’s needs and also evolve with the University

Compliance: Commitment to upholding state and federal legal requirements

Equity: Pay practices that promote fairness

Performance excellence: Rewards for contributions that align with and support the University’s mission and goals

Market excellence*: Market-guided salary structures aligned to the relevant markets and subject to University feasibility

FOR YOUR RECORDS

Full compensation philosophy

We’ve provided a PDF with a detailed description and overview of our compensation philosophy for your reference.

Pay Structure

Our pay structure is based on our Compensation Philosophy and does the following:

- Supports fairness with job alignment and pay practices

- Aligns with and supports the University’s mission and goals

- Is guided by the market for the job

The pay structure consists of market-guided pay ranges, which are determined by the job’s responsibilities and role.

Learn more about job structure, including job levels, career streams, and job family groups and job families.

Our pay structure is guided by four key principles:

- Transparency of policies, guidelines, and procedures

- A clear and articulate structure to ensure consistency across the organization

- Adaptability to meet the needs of our evolving workforce today and tomorrow

- Compliance with both state and federal law

Bargaining Unit staff should refer to their collective bargaining agreements for pay details.

General Pay Structure – Hourly

| Pay Range | Min | Max |

|---|---|---|

| URG 102 | $16.50 | $21.45 |

| URG 103 | $16.92 | $23.69 |

| URG 104 | $18.10 | $25.35 |

| URG 105 | $19.37 | $27.12 |

| URG 106 | $20.92 | $29.29 |

| URG 107 | $22.59 | $31.63 |

| URG 108 | $24.40 | $34.16 |

| URG 109 | $26.35 | $36.90 |

| URG 110 | $28.46 | $39.85 |

| URG 111 | $30.06 | $45.08 |

| URG 112 | $33.06 | $49.59 |

| URG 113 | $36.37 | $54.55 |

| URG 114 | $40.73 | $61.10 |

| URG 115 | $45.82 | $68.74 |

| URG 116 | $51.55 | $77.33 |

| URG 117 | $58.00 | $86.99 |

| URG 118 | $66.70 | $100.04 |

| URG 119 | $76.70 | $115.05 |

| URG 120 | $84.81 | $135.70 |

| URG 121 | $97.53 | $156.05 |

| URG 122 | $112.16 | $179.46 |

General Pay Structure – Annual

| Pay Range | Min | Max |

|---|---|---|

| URG 102 | $34,320 | $44,616 |

| URG 103 | $35,194 | $49,275 |

| URG 104 | $37,648 | $52,728 |

| URG 105 | $40,290 | $56,410 |

| URG 106 | $43,514 | $60,923 |

| URG 107 | $46,987 | $65,790 |

| URG 108 | $50,752 | $71,053 |

| URG 109 | $54,808 | $76,752 |

| URG 110 | $59,197 | $82,888 |

| URG 111 | $62,525 | $93,766 |

| URG 112 | $68,765 | $103,147 |

| URG 113 | $75,650 | $113,464 |

| URG 114 | $84,718 | $127,088 |

| URG 115 | $95,306 | $142,979 |

| URG 116 | $107,224 | $160,846 |

| URG 117 | $120,640 | $180,939 |

| URG 118 | $138,736 | $208,083 |

| URG 119 | $159,536 | $239,304 |

| URG 120 | $176,405 | $282,256 |

| URG 121 | $202,862 | $324,584 |

| URG 122 | $233,293 | $373,277 |

Clinical Pay Structure – Hourly

| Pay Grade | Min | Max |

|---|---|---|

| URC 202 | $16.50 | $21.45 |

| URC 203 | $17.00 | $22.95 |

| URC 204 | $17.80 | $24.04 |

| URC 205 | $19.14 | $25.84 |

| URC 206 | $20.57 | $27.78 |

| URC 207 | $22.12 | $29.86 |

| URC 208 | $23.28 | $32.59 |

| URC 209 | $25.03 | $35.04 |

| URC 210 | $25.77 | $36.06 |

| URC 211 | $27.69 | $38.75 |

| URC 212 | $29.76 | $41.68 |

| URC 213 | $32.02 | $44.81 |

| URC 214 | $34.42 | $48.17 |

| URC 215 | $36.97 | $51.78 |

| URC 216 | $39.76 | $55.67 |

| URC 217 | $42.69 | $59.76 |

| URC 218 | $45.10 | $67.64 |

| URC 219 | $51.88 | $77.84 |

| URC 220 | $62.26 | $93.41 |

| URC 221 | $76.13 | $114.19 |

| URC 222 | $89.71 | $134.57 |

| URC 223 | $107.60 | $161.39 |

| URC 201 | $15.00 | $20.25 |

Some clinical ranges have defined start rates outside of this table. For specific information regarding your range, please visit the Job Structure Alignment self-service page in HRMS.

Clinical Pay Structure – Annual

| Pay Range | Min | Max |

|---|---|---|

| URC 202 | $34,320 | $44,616 |

| URC 203 | $35,360 | $47,736 |

| URC 204 | $37,024 | $50,003 |

| URC 205 | $39,811 | $53,747 |

| URC 206 | $42,786 | $57,782 |

| URC 207 | $46,010 | $62,109 |

| URC 208 | $48,422 | $67,787 |

| URC 209 | $52,062 | $72,883 |

| URC 210 | $53,602 | $75,005 |

| URC 211 | $57,595 | $80,600 |

| URC 212 | $61,901 | $86,694 |

| URC 213 | $66,602 | $93,205 |

| URC 214 | $71,594 | $100,194 |

| URC 215 | $76,898 | $107,702 |

| URC 216 | $82,701 | $115,794 |

| URC 217 | $88,795 | $124,301 |

| URC 218 | $93,808 | $140,691 |

| URC 219 | $107,910 | $161,907 |

| URC 220 | $129,501 | $194,293 |

| URC 221 | $158,350 | $237,515 |

| URC 222 | $186,597 | $279,906 |

| URC 223 | $223,808 | $335,691 |

| URC 201 | $31,200 | $42,120 |

Some clinical ranges have defined start rates outside of this table. For specific information regarding your range, please visit the Job Structure Alignment self-service page in HRMS.

HR Modernization: New CPM Job and Pay Structures Launch

Learn about the Career Path Modernization (CPM) project, the University’s effort to transform how we hire, pay, develop, and advance our workforce. We are committed to providing a clear, easy to understand job structure that aligns jobs, levels, and positions across the institution to deliver consistency, equity, and transparency to a wide variety of opportunities, roles, and career paths.

Pay Administration Guidelines

The University of Rochester recognizes that its most valuable resource is its people. The University’s compensation program is designed to attract, retain and motivate a highly talented and committed workforce in support of the University’s mission and goals.

This section describes the pay administration guidelines that will be used to ensure continued alignment of employee pay with the compensation philosophy and program design, and promote consistency across the institution. These guidelines are intended to be applied consistently across the University, while providing flexibility in certain situations as necessary to meet organizational needs. While the University intends to maintain these guidelines to ensure stability in our policies and practices, we reserve the right to modify them in coordination with the Compensation Governance Committee (CGC), at any time, with or without notice.

Watch the overview video below or explore components of the Pay Administration Guidelines via the drop-downs. Or, you can download the Pay Administration Guidelines.

Program components

The University’s staff compensation program is designed to provide a foundation for staff compensation and career progression.

The benefits of the key program components are detailed below.

- Pay ranges provide University-wide consistency on the classification of similar jobs and recognize various levels of impact and complexity of work.

- The compensation structure establishes market-reference pay ranges to help ensure alignment with the market and a systematic method for making pay decisions.

- Pay administration guidelines articulate how decisions regarding compensation will be made at the University under a variety of employment situations.

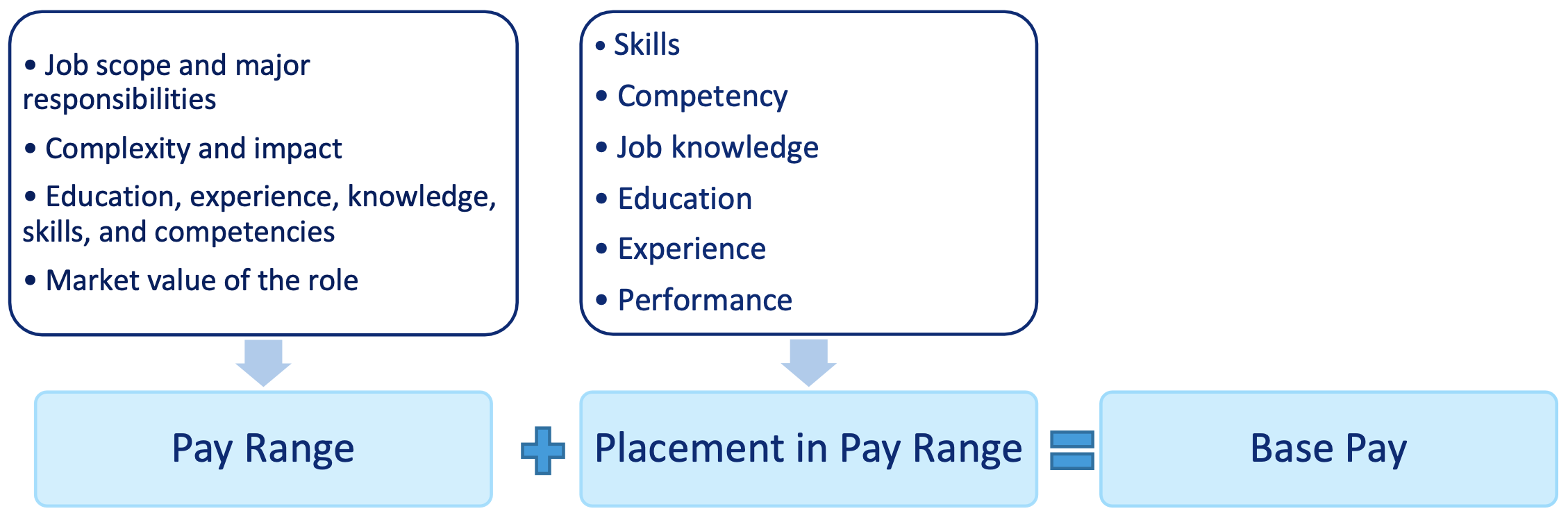

The overall design of the compensation program is simple: job content and role determine the pay range of the job, and the specific responsibilities and scope, combined with the skills, knowledge, education, experience and performance of the job holder determine the individual’s base pay within the range.

Figure 1. Both job and employee determine appropriate base pay

The compensation program has been designed to meet the current and future needs of the University of Rochester to effectively retain, recruit, motivate, and develop administrators and staff. The Compensation Governance Committee, Human Resources, Managers and Employees have important roles to play in program governance.

Compensation Governance Committee

The Compensation Governance Committee consists of the President, Provost, CEO of the Medical Center, Executive Vice President for Administration and Finance, Vice President and General Counsel, Senior Vice President for Human Resources and Chief Human Resources Officer, Vice President for Equity and Inclusion, and Vice President for Communications. The Committee plays a pivotal role in ensuring that the compensation program is competitive and equitable, administered in accordance with its design, and maintained to ensure ongoing relevance. Specific responsibilities include the following:

- Define compensation philosophy and support the compensation program’s implementation

- Partner with Human Resources to maintain policies, ensure alignment with institutional needs, and promote equity, fairness, and competitive compensation

- Support and promote the program by ensuring managers and employees understand the development and maintenance of the program

Human Resources

Human Resources is responsible for evaluating the compensation program and providing relevant data and processes to ensure compensation decisions are competitive, equitable, and meet regulatory standards. Human Resources will partner with managers and leaders, providing specialized experience and expertise to:

- Administer and maintain the University of Rochester’s compensation structure

- Provide detailed review, analysis, data, and recommendations to support compensation and classification decisions

- Provide information, education and advice on market practices, trends, and analysis to leaders, managers, and employees

- Partner with and support managers in compensation determination decisions

- Administer classification and compensation decisions and actions

- Audit how compensation is administered to ensure legal compliance, equity and alignment with effective compensation practices

- Assess and respond to leader, manager, and employee questions and concerns regarding compensation

Managers and supervisors

Managers and supervisors play a critical role in ensuring credibility, consistent application of the guidelines, and communication with employees. Specifically, responsibilities of managers and supervisors include:

- Obtain and maintain knowledge of the program and how it impacts employees in their area of accountability

- Support the program by following its guidelines and providing thorough and accurate information when recommending compensation and classification changes for employees

- Consult with Human Resources to ensure alignment to compensation and classification guidelines

- Communicate positively and proactively with employees to inform them about the program and how it affects them, along with providing feedback to the applicable HR Business Partner as applicable

Employees

While employees are not responsible for making compensation decisions or actively managing the program, they do have other important responsibilities:

- Understand the program by familiarizing themselves with the information provided by the University regarding their current role as well as possible career advancement opportunities

- Discuss questions or concerns with their manager

- Perform job responsibilities effectively and ask for guidance when necessary

Compensation Structure Development

The University of Rochester compensation structures consist of two separate structures: (1) General Structure and (2) Clinical Structure, which are each based on competitive market data, best practices in compensation program design, and the University of Rochester’s specific needs, with a focus on balancing the flexibility necessary to hire and promote the best talent. The structures also provide a framework for helping to ensure internal equity across the University.

The compensation structures were developed using available compensation survey market data. Data from various survey vendors, including Mercer, Willis Towers Watson (WTW), Culpepper Life Sciences, Pandion Optimization Alliance, and Western Management Group’s EduComp, are referenced to assess compensation at higher education institutions, research and healthcare organizations, as well as general industry employers. This set of market data recognizes that the University of Rochester must compete across a broader competitive landscape for certain roles. The University will continually assess the competitive landscape of its jobs and adjust market data sources as needed.

Market data collected typically provides a range of average pay for a particular role. The University uses market median data points to establish a range of pay which was created around that market data to accommodate a wide variety of skill and experience levels of job incumbents. The University will continue to review market benchmarks and adjust University pay ranges as necessary.

Pay range

Each pay range has a minimum and maximum rate of pay that defines the lower and upper range of compensation for a given role. Jobs are assigned to a range based on the market data and the following criteria for each job:

- scope and major responsibilities

- complexity and impact

- knowledge, skills, and competencies

- minimum education and experience required

The compensation program’s pay ranges are wide enough to accommodate a variety of experience and performance levels, and all employees can expect to be paid within the pay range associated with their job’s pay range.

Annual Performance-Based Merit Increase

The University generally administers an annual merit increase as an opportunity to provide employees with an increase in pay based on their performance during the prior year. An employee’s merit increase is assessed during the annual performance evaluation process and takes into consideration the overall salary increase budget (if any) and the competitiveness of current pay (e.g., relationship of current base salary to the competitive range for the role).

- Merit increases for recently hired staff will be prorated based on the hire date of the individual. Details will be provided in the July merit program guidelines in the spring of each year.

- Staff who have been promoted or transferred to a new role BEFORE May 1 of a given year will remain eligible for the annual merit program.

- Staff who have been promoted or transferred to a new role AFTER May 1 of a given year will be offered a pay rate that accounts for the upcoming merit program.

It is important to note that performance-based merit increases are NOT considered a cost-of-living increase.

“Above the Range” salaries

An employee’s base pay (whether salary or hourly) is categorized as “Above the Range” when their base pay is above the maximum amount of their current pay range. There may be rare cases where an employee will be paid this way due to historical pay decisions. If Human Resources confirms that an employee is in the correct job, the job is assigned to the correct range, and the employee’s base pay is more than 120% of the maximum amount of their job’s pay range, the employee may receive lump sum pay increases rather than increases to their base pay through the annual merit program. Importantly, the availability of funds for an annual merit increase or otherwise is not a basis for setting a salary that exceeds the pay guidelines for a given position.

Equity and market adjustments

The University of Rochester will remain vigilant about preventing and resolving any pay inequities that may arise in the future. If a review of staff pay surfaces discrepancies attributable to inequity, Human Resources will work with department leaders to prioritize necessary compensation adjustments.

- “Equity Adjustment” refers to a pay adjustment made to ensure that an employee’s pay appropriately reflects their knowledge, skills, experience, and education in relationship to others in similar positions. In some instances, this may also be tied to movement to a job classification that more accurately reflects the type and level of work being performed in the position. Equity adjustments may be approved and processed at any time throughout the year.

At times, it may also be necessary to adjust pay to recognize significant market changes.

- “Market Adjustment” refers to a pay adjustment to recognize significant, sustained increases in the market value of a given job. The compensation program will be maintained to reflect overall market movement, but occasionally, unusual market circumstances may warrant targeted adjustments to a job or group of similar jobs. These are typically processed with the annual performance-based merit increases, but market conditions may require they occur at other times in the year.

New hire pay determination

It is important to establish appropriate pay for all new hires to the University of Rochester, which reflects the employee’s relevant skills, knowledge, competencies, and experience, and is also equitable compared to current University of Rochester employees.

Promotions

A promotion is defined as an employee’s movement to a job in a higher pay range and/or career level.

If a promotion is warranted, the manager will partner with Human Resources to document and confirm that the employee is or will be functioning at a different level in terms of scope, responsibility and complexity. Upon promotion, a determination will be made regarding the appropriate salary for the new role within the new salary range, based on the employee’s skill, knowledge, experience, performance, and internal equity. Since circumstances vary, the following factors will be considered:

- Demonstrated knowledge and skills at the new role level

- Pay of other similarly situated employees

The goal is to start the employee at the appropriate point in the pay range for the new job, rather than apply a uniform promotional pay increase in all circumstances.

Demotions

A voluntary demotion occurs when an employee applies for, and accepts, a job in a lower pay range. This may warrant a pay decrease, with the amount determined by taking into account the employee’s current pay, the new pay range, the knowledge, skills, and performance of the incumbent, and pay of other similarly situated employees.

Transfer/lateral moves

A transfer/lateral move occurs when an employee accepts a job in the same pay range as their former position.

Since jobs in the same pay range are generally equivalent in terms of level of responsibility and market pay, a salary adjustment is usually not warranted following a lateral move. Proposed pay adjustments must be rationalized and documented similarly to in-range adjustments to recognize a higher level of performance relative to the new job.

Part-time employees

Pay for part-time employees who are working at least 17.5 hours per week and are not seasonal or occasional workers should be determined using the same principles as for full-time employees, then pro-rated to reflect the employee’s work schedule.

Non-exempt jobs

- A staff member in a non-exempt job who works part-time will be paid the regular hourly wage for the position, considering the employee’s skills, knowledge, experience, and performance in relationship to others in similar positions. An estimated annual pay figure can be calculated by multiplying this hourly rate by the number of hours the employee is scheduled to work per year. Staff members in non-exempt jobs will be paid for all hours actually worked, and will be eligible for overtime in accordance with the Fair Labor Standards Act (i.e., overtime is payable for hours worked in excess of 40 per week).

Exempt jobs

- The salary for a staff member in an exempt job who works part-time will be determined by pro-rating the salary they would have received as a full-time employee working in the same job. The job will be assigned to a pay range based on roles and responsibilities at University of Rochester, and the employee’s salary

Assumptions

| Annual full-time base salary | $60,000 |

| Full-time work week | 5 days |

| Scheduled days per week | 3 days |

| Part-time percentage (3 divided by 5) | 60% |

Calculation of annual part-time salary

| Annual full-time salary | $60,000 |

| times Part-time percentage | x 60% |

| Annual part-time salary | $36,000 |

Part-time staff must both (1) be paid on a salary basis that meets or exceeds the current FLSA and NYS salary thresholds, and (2) satisfy the appropriate duties test under the applicable FLSA and NYS legal requirements, to be considered salaried and exempt from the overtime pay requirement.

If a part-time staff member in an exempt, salaried job works beyond the expected number of work hours, the employee is not eligible for overtime pay. If the part-time staff member consistently works beyond expected number of work hours, the employee’s manager should investigate the reasons this is occurring and determine an appropriate solution. Some reasons could include increased workload or lack of resources. If the work schedule on which the prorated salary was originally based consistently proves not to meet the needs of the department, the schedule should be renegotiated and the pay re-calculated accordingly.

Additional Work and Additional Compensation Policy

The University’s Additional Work and Additional Compensation Policy (Policy 211) allows, in certain cases, for additional pay to be provided to an eligible employee for additional work assigned to them that is clearly above the scope of their primary job classification and is performed outside of normal duties on a temporary basis. Arrangements for additional pay should occur under extraordinary circumstances only, and must be approved by the appropriate department and Human Resources before the assignment of work to an employee. Furthermore, the additional work typically should not last for more than four weeks at a time. For work that will last more than four weeks, contact Human Resources to discuss alternatives.

If the work being performed is outside of the employee’s primary department, approval must be obtained by a supervisor in the primary department before any work is performed. No commitment to an employee for such work and compensation is binding until so approved. Where the additional work is of a continuing nature and becomes a normal responsibility of the job, contact Human Resources and update the job description with the additional responsibilities. Human Resources will then review these extra responsibilities and assess if an adjustment to the base pay is appropriate. For additional information related to the Additional Compensation Policy, please contact Human Resources.

Compensation Structure and Pay Review Process

To remain effective and competitive, it is the University of Rochester’s intention to review the compensation structure annually and update the compensation structure as market trends and University needs warrant.

Structure adjustments will be based on market survey data. The Human Resources team will conduct an annual review of market compensation structure movement.

A comprehensive assessment of benchmark jobs will be conducted every 3-4 years to identify any particular market trends (job groupings, specific jobs, etc.) that may warrant change to position within the structure.

The following terms and concepts are used in this document and are defined as shown below (listed in alphabetic order).

| Term | Definition |

|---|---|

| Above The Range | When an employee’s pay rate exceeds the maximum of the pay range, the employee’s situation shall be considered “above the range” |

| Base Pay Range | A minimum and maximum compensation amount within which an individual’s base pay should fall, as guided by the external competitive market. |

| Benchmark Job | A job whose major responsibilities and requirements are commonly found in the market. These jobs are typically included in salary surveys and have reliable market data that is readily available year after year. |

| Compensation Program | The program that provides a framework for managing compensation at University of Rochester. The program consists of a benchmarking methodology, a pay structure, and guidelines for managing pay. |

| Demotion | The movement of an employee into a job that is assigned to a lower pay range and/or career level than the employee’s current job. |

| Equity Adjustment | An adjustment that is made to ensure that an employee’s salary appropriately reflects the employee’s skills, competency, job knowledge, education, experience, and sustained contribution in relationship to others in similar positions. |

| Exempt vs. Non-Exempt | Exempt – An individual who is exempt from the minimum wage and overtime provisions of the FLSA and New York State Labor Law. Exempt employees are paid an established salary above a mandated threshold, are expected to perform exempt duties, and are expected to fulfill the duties of their jobs regardless of the number of hours worked. Employees in exempt jobs are NOT eligible to receive overtime compensation. Non-Exempt – An individual who is subject to the minimum wage and overtime provisions of the FLSA and New York State Labor Law, and who is entitled to overtime pay for all hours worked beyond 40 in a workweek. Non-exempt employees are required to accurately report all hours worked so that they can be paid for all hours worked, including any overtime hours. Overtime hours are compensated at 1.5 times the employee’s regular hourly rate of pay. |

| Fair Labor Standards Act (FLSA) | A Federal law that establishes minimum wage, overtime pay, recordkeeping, and other employment standards. The law includes specific “tests” to determine whether a job will be subject to the minimum wage and overtime provisions of the law (classified as “non- exempt”) or not subject to the minimum wage and overtime provisions of the law (classified as “exempt”). These tests consider (1) the form and amount of compensation for the role and (2) job duties required for the role. These tests do not consider the characteristics of a specific employee (such as education, experience, skills, or performance). Similar requirements exist under New York State Labor Law. |

| Lateral Move | The movement of an employee to a job that is assigned to the same pay range as the employee’s current job. |

| Market Adjustment | Refers to a salary adjustment that is made to recognize compensation changes in the marketplace for a specific job. |

| Off-Cycle Increase | A pay increase that occurs outside of the normal annual increase cycle. |

| Pay Range | A compensation range to which jobs are assigned based on the job scope and major responsibilities; complexity and impact; knowledge, skills, and competencies; and education and experience. |

| Promotion | The movement of an employee to a job that is in a higher pay range than the employee’s current job. |

| Transfer | The movement of an employee to a job that is assigned to the same pay range as the employee’s current job. |

Beyond compensation

Working at the University has value beyond a paycheck, including health care, retirement, wellness opportunities, tuition waivers, a home ownership program, staff awards and recognition programs, as well as other discounts and perks.

Career Path Modernization

The Career Path Modernization project is a new initiative which will enhance job titles, pay grades, and career paths across the institution.

See the project timeline and scope

Total Rewards statement

The annual Total Rewards Statement provides current employees with a personalized snapshot of their overall compensation, beyond just their paycheck.

To see your statement, log into HRMS using your Net ID. Follow the path “Self Service > Benefits > Total Rewards Statement”.

View statement in HRMS

Awards and recognition

Each year we honor staff members for their commitment to our mission and outstanding contributions to the University community.

Learn about employee recognition

Learning and development

We provide professional development programs to help employees keep up with skills, expand their knowledge, and work better together.

Discover growth opportunities

Total Rewards: Benefits, Pay & Perks

Our Total Rewards package goes beyond basic benefits and compensation. It’s the comprehensive way we reward our employees.

Timekeeping

To ensure employees are accurately paid for time worked and the University is compliant with state and federal laws, it’s important that employees are following all time reporting processes. Below are resources to assist you.

Our Manager’s Toolkit has specific timekeeping rules, training, and guidance for managers specifically. Additional helpful resources are included below—these are PDF files for easy downloading and printing.

- Kronos badge reader guide

- Kronos badge reader locations

- Web clock guide

- Time entry guide

- Quick reference guide for reporting time in HRMS

- Quick reference guide for reporting time – PAS classifications paid hourly

- Employee time reporting training slides

- Timekeeping rules summary for hourly-paid employees

What managers need to know

Manager’s Toolkit

Supervisors and managers have a responsibility to ensure compliance with state and federal laws. Find resources related to time reporting processes established so employees are paid properly.